Which candle is best for forex trading?

There are numerous candlestick patterns that traders use in Forex trading, but some of the most reliable ones include the evening star and morning star patterns, which signal trend reversals. Other reliable patterns consist of the hammer and inverted hammer, the engulfing pattern, and the harami pattern.

There are numerous candlestick patterns that traders use in Forex trading, but some of the most reliable ones include the evening star and morning star patterns, which signal trend reversals. Other reliable patterns consist of the hammer and inverted hammer, the engulfing pattern, and the harami pattern.

The pattern requires three candles to form in a specific sequence, showing that the current trend has lost momentum and a move in the other direction might be starting.

The shooting star candlestick is primarily regarded as one of the most reliable and one of the best candlestick patterns for intraday trading. In this type of intra-day chart, you will typically see a bearish reversal candlestick, which suggests a peak, as opposed to a hammer candle which suggests a bottom trend.

Which Candlestick Pattern is Most Reliable? Many patterns are preferred and deemed the most reliable by different traders. Some of the most popular are: bullish/bearish engulfing lines; bullish/bearish long-legged doji; and bullish/bearish abandoned baby top and bottom.

- Average true range (ATR)

- Moving average convergence/divergence (MACD)

- Fibonacci retracements.

- Relative strength index (RSI)

- Pivot point.

- Stochastic.

- Parabolic SAR.

- Ichimoku Cloud.

When to buy and sell forex. Knowing when to buy and sell forex depends on many factors, such as market opening times and your FX trading strategy. Many traders agree that the best time to buy and sell currency is generally when the market is most active – when liquidity and volatility are high.

Clear guidelines: The 5-3-1 strategy provides clear and straightforward guidelines for traders. The principles of choosing five currency pairs, developing three trading strategies, and selecting one specific time of day offer a structured approach, reducing ambiguity and enhancing decision-making.

On a 1-hour chart, for instance, each candlestick represents one hour of activity. On a daily chart, it's a single day. The most recent candle is an exception to this rule. It shows you what's happening in the current session.

| Candlestick Pattern | Direction |

|---|---|

| Morning Star | Bullish (Reversal) |

| Bullish Engulfing | Bullish (Reversal) |

| Doji | Bullish/Bearish (Indecision) |

| Hammer | Bullish (Reversal) |

Which candle is best for bullish?

A black or filled candlestick means the closing price for the period was less than the opening price; hence, it is bearish and indicates selling pressure. Meanwhile, a white or hollow candlestick means that the closing price was greater than the opening price. This is bullish and shows buying pressure.

Positive colors like green may encourage bullish sentiments, while negative colors like red could prompt caution or bearish sentiments, impacting trading strategies.

The 5 candle rule is a common trading method in which precise candlestick patterns are identified over a five-day period to anticipate price moves.

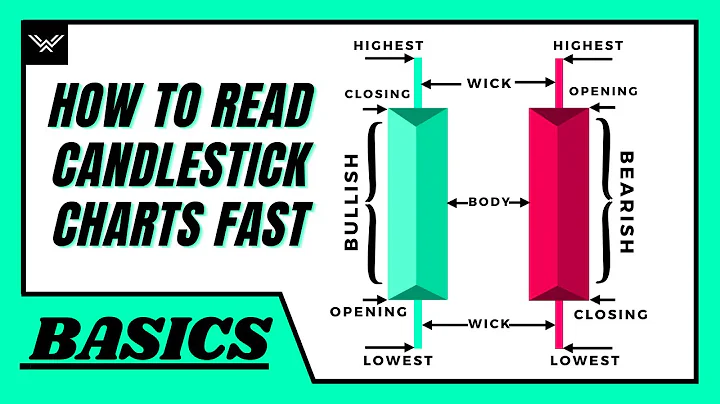

How do I read a candlestick chart? The price range between the open and closed positions of a candlestick is plotted as a rectangle on the single line. If the close is above the open, the body of the rectangle is white. If the close of the day is below the open, the body of the rectangle is red.

- Open - representing the first trade executed during the specified period.

- High - indicating the highest traded price observed during the period.

- Low - denoting the lowest traded price recorded within the period.

Popular trading strategies include trend following, range trading, or breakout trading. Traders who choose this type of trading style need patience and discipline. It might take days for a quality opportunity to show up, or you might end up holding a trade open for a week or more while running an open loss.

- Stochastic oscillator.

- Moving average convergence divergence (MACD)

- Bollinger bands.

- Relative strength index (RSI)

- Fibonacci retracement.

- Ichimoku cloud.

- Standard deviation.

- Average directional index.

What is the hardest month to trade forex? In June, July and August, volatility slows down due to the summer season, making it a less popular time to trade forex. The reduced trading activity during summer results from the changing habits of large market movers.

Night trading on the forex markets has advantages for new traders as volatility tends to be lower and for experienced traders using scalping or automatic trading strategies that tend to work well with less volatility.

Common Forex Trading Time Frames

Day Trading (1-hour to 4-hours): Day traders hold their positions for a day or less, closing them before the market closes. Swing Trading (4-hours to daily): Swing traders hold their positions for a few days to weeks, aiming to capture larger price movements.

What is the 90% winning forex strategy?

By combining three different Relative Strength Index (RSI) indicators, you can potentially achieve a win rate of up to 90%. The three RSI indicators used in this strategy are the 14-period RSI, 7-period RSI, and 3-period RSI. Each of these indicators plays a crucial role in identifying market trends and momentum.

While it can be a lucrative venture for some, it is also known to be a high-risk activity. This is where the 90 rule in Forex comes into play. The 90 rule in Forex is a commonly cited statistic that states that 90% of Forex traders lose 90% of their money in the first 90 days.

Let profits run and cut losses short Stop losses should never be moved away from the market. Be disciplined with yourself, when your stop loss level is touched, get out. If a trade is proving profitable, don't be afraid to track the market.

A shadow, or a wick, is a line found on a candle in a candlestick chart that is used to indicate where the price of a stock has fluctuated relative to the opening and closing prices. Essentially, these shadows illustrate the highest and lowest prices at which a security has traded over a specific time period.

- If the upper wick on a red candle is short, then it indicates that the stock opened near the high of the day.

- On the other hand, if the upper wick on a green candle is short, then it indicates that the stock closed near the high of the day.

References

- https://www.litefinance.org/blog/for-beginners/trading-strategies/three-profitable-forex-trading-strategies/

- https://www.ig.com/en/trading-strategies/the-best-beginners--guide-to-buying-and-selling-forex-201127

- https://squareup.com/us/en/the-bottom-line/series/quickstart-guide/how-to-start-a-candle-business

- https://www.dailyfx.com/education/candlestick-patterns/top-10.html

- https://www.axiory.com/trading-resources/basics/how-to-read-candlesticks-charts

- https://www.investopedia.com/articles/active-trading/062315/using-bullish-candlestick-patterns-buy-stocks.asp

- https://www.fmz.com/strategy/435828

- https://www.forex.com/en/news-and-analysis/how-to-read-candlestick-charts/

- https://www.linkedin.com/pulse/how-long-should-i-hold-forex-trade-best-trader-2lv2c

- https://www.nirmalbang.com/knowledge-center/intraday-trading-charts.html

- https://www.asiaforexmentor.com/how-to-read-candlesticks/

- https://altfins.com/knowledge-base/ema-12-50-crossovers/

- https://www.quora.com/How-many-candles-can-you-use-on-a-chart-before-the-accuracy-starts-to-decrease

- https://fastercapital.com/content/Candlestick-vs--Renko-Charts--Which-is-the-Best-for-Technical-Analysis.html

- https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615

- https://www.axi.com/uk/blog/education/forex/forex-charts

- https://www.vellabox.com/five-secrets-for-the-best-candle-experience/

- https://aliceblueonline.com/what-is-pullback-trading/

- https://www.investopedia.com/articles/active-trading/040914/understanding-hanging-man-optimistic-candlestick-pattern.asp

- https://www.thatsucks.com/four-candles-strategy-advanced-breakout-strategy-for-binary-options/

- https://kriptomat.io/finance-investing/candlestick-chart/

- https://bitcointalk.org/index.php?topic=3209219.0

- https://zerodha.com/varsity/chapter/single-candlestick-patterns-part-2/

- https://www.tradingsim.com/blog/5-minute-bar

- https://www.linkedin.com/posts/christopher-duffy-bdpim_candle-patterns-professional-traders-often-activity-7096048888326807552-bij5

- https://nononsensetrader.com/1-candle-rule/

- https://en.wikipedia.org/wiki/Candlestick_chart

- https://realtrading.com/trading-blog/1-minute-scalping-simple-smart-profit-driven-strategies/

- https://www.ig.com/uk/forex/fx-need-to-knows/forex-indicators

- https://www.linkedin.com/pulse/top-20-chart-candlestick-patterns-traders-union-olga-shendetskaya-jqbne

- https://tradeciety.com/how-to-trade-candlestick-patterns-like-a-pro

- https://www.indiainfoline.com/knowledge-center/online-share-trading/candlestick-wick-analysis

- https://www.forex.com/ie/news-and-analysis/how-to-use-the-5-3-1-trading-strategy-in-forex/

- https://www.investopedia.com/terms/t/three_white_soldiers.asp

- https://www.investopedia.com/trading/candlestick-charting-what-is-it/

- https://tradingwalk.com/simple-candlestick-strategy

- https://www.fxstreet.com/education/golden-rules-of-trading-202312051327

- https://capital.com/best-currency-pairs-to-trade-at-night

- https://www.warriortrading.com/how-to-read-stock-charts-for-beginners/

- https://en.wikipedia.org/wiki/Temple_menorah

- https://www.scribd.com/document/635378618/Two-Candle-Theory-High-Probability-Trades

- https://centerpointsecurities.com/bullish-candlestick-patterns/

- https://blueberrymarkets.com/market-analysis/news/what-is-5-3-1-trading-strategy/

- https://www.dummies.com/article/business-careers-money/personal-finance/investing/investment-vehicles/stocks/candlestick-charting-for-dummies-cheat-sheet-209309/

- https://www.indmoney.com/articles/stocks/best-candlestick-patterns-for-trading-what-are-the-key-components-to-analyze

- https://www.kotaksecurities.com/intraday-trading/which-time-frame-is-best-for-intraday-trading/

- https://www.investopedia.com/terms/p/pip.asp

- https://www.linkedin.com/pulse/1-minute-time-frame-good-trading-forex-guru-eoapc

- https://www.ig.com/us/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615

- https://www.babypips.com/learn/forex/triple-candlestick-patterns

- https://the5ers.com/five-best-forex-candlestick-patterns/

- https://www.investopedia.com/terms/s/shadow.asp

- https://www.axi.com/int/blog/education/forex/forex-trading-strategies

- https://www.litefinance.org/blog/for-beginners/how-to-read-candlestick-chart/single-candlestick-patterns/

- https://www.t4trade.com/en/what-is-the-hardest-month-to-trade-forex/

- https://www.angelone.in/knowledge-center/share-market/intraday-chart-patterns

- https://www.ig.com/en/trading-strategies/10-trading-indicators-every-trader-should-know-190604

- https://renner.org/article/golden-candlesticks/

- https://school.stockcharts.com/doku.php?id=chart_analysis:candlestick_bullish_reversal_patterns

- https://www.gffbrokers.com/harnessing-the-5-8-13-exponential-moving-average-ema-trading-indicator/

- https://www.whselfinvest.com/en-be/trading-platform/free-trading-strategies/tradingsystem/55-1-minute-breaks-daytrading-scalping-free

- https://www.strike.money/technical-analysis/triple-candlestick-patterns

- https://wealthyeducation.com/win-90-percent-of-the-time/

- https://www.mystockodds.com/blog/is-candlestick-trading-accurate

- https://www.companionlink.com/blog/2023/02/what-charts-do-professional-traders-use/

- https://www.bitpanda.com/academy/en/lessons/bullish-candlestick-patterns-in-crypto-trading-you-should-know

- https://www.quantifiedstrategies.com/do-candlesticks-work-a-quantitative-test/

- https://fxopen.com/blog/en/three-working-5-minute-trading-strategies/

- https://www.jaspersoft.com/articles/what-is-a-candlestick-chart

- https://www.babypips.com/trading/top-7-candlestick-patterns-to-use-in-trading-forex-and-crypto

- https://groww.in/blog/how-to-read-candlestick-charts

- https://www.investopedia.com/terms/t/three-inside-updown.asp

- https://www.investopedia.com/ask/answers/07/candlestickcolor.asp

- https://www.investopedia.com/terms/d/downside-tasuki-gap.asp

- https://choiceindia.com/blog/best-time-frame-for-intraday-trading/

- https://www.investorsunderground.com/stock-charts/candlestick-charts/

- https://www.linkedin.com/pulse/what-90-rule-forex-broker-forex-global-czp0c

- https://blog.whitebit.com/en/what-is-a-hammer-candlestick-pattern/

- https://www.investopedia.com/articles/active-trading/092315/5-most-powerful-candlestick-patterns.asp

- https://zebpay.com/in/blog/how-to-read-candlestick-patterns

- https://www.linkedin.com/pulse/10-golden-rules-forex-trading-broker-forex-global-nxc5c

- https://realtrading.com/trading-blog/candlestick-patterns-day-trading/

- https://www.quora.com/How-do-I-predict-the-next-candle-in-binary-trading-with-pressure-and-shock

- https://www.dailyfx.com/education/candlestick-patterns/forex-candlesticks.html

- https://investfox.com/education/indicators/best-one-minute-moving-average/

- https://www.audacitycapital.co.uk/trading-guides/forex-for-beginners/how-much-to-start-forex-trading/

- https://www.quora.com/Is-it-important-to-learn-candlesticks-chart-pattern-to-be-successful-in-stock-market

- https://www.5paisa.com/stock-market-guide/online-trading/how-to-read-candlestick-charts-for-day-trading

- https://www.forextime.com/education/candlestick-trading-charts

- https://blog.mexc.com/the-best-candlestick-patterns-for-crypto-trading-creator-wilbur/

- https://www.forbes.com/advisor/investing/what-is-day-trading/

- https://www.quora.com/What-is-a-one-hour-candle-in-Forex-trading-and-what-advantages-does-it-have-over-other-expiry-times-such-as-five-minutes-or-ten-minutes

- https://www.quantifiedstrategies.com/what-is-the-best-time-frame-for-candlesticks/

- https://fxopen.com/blog/en/how-to-trade-with-three-inside-up-down-candlestick-patterns/

- https://www.marklittler.com/sell-your-antique-silver-candlesticks/

- https://www.quantifiedstrategies.com/how-many-candlestick-patterns-are-there/

- https://www.quora.com/What-is-the-5-candle-rule

- https://learn.bybit.com/candlestick/how-to-read-candlestick-charts/

- https://www.xtb.com/en/education/what-are-the-best-trading-days-for-forex