How do you read forex candlesticks?

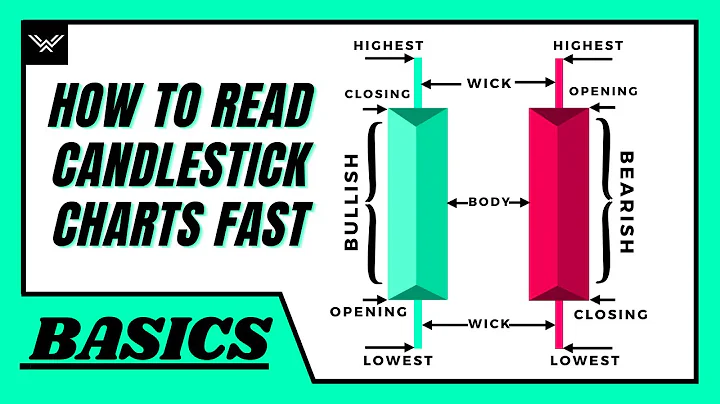

The solid part is the body of the candlestick. The lines at the top and bottom are the upper and lower wicks, also called tails or shadows. The very peak of a candle's wick is the highest price for that time period, while the bottom of the wick is the lowest price for that particular time period.

A short upper wick on a red candle suggests the stock opened near its daily high. Conversely, a short upper wick on a green candle suggests the stock closed near its daily high. In summary, a candlestick graph presents the relationship between a stock's high, low, opening, and closing prices.

How do I read a candlestick chart? The price range between the open and closed positions of a candlestick is plotted as a rectangle on the single line. If the close is above the open, the body of the rectangle is white. If the close of the day is below the open, the body of the rectangle is red.

The 5 candle rule is a common trading method in which precise candlestick patterns are identified over a five-day period to anticipate price moves.

This triple candlestick pattern indicates that the downtrend is possibly over and that a new uptrend has started. For a valid three inside up candlestick formation, look for these properties: The first candle should be found at the bottom of a downtrend and is characterized by a long bearish candlestick.

Which Candlestick Pattern is Most Reliable? Many patterns are preferred and deemed the most reliable by different traders. Some of the most popular are: bullish/bearish engulfing lines; bullish/bearish long-legged doji; and bullish/bearish abandoned baby top and bottom.

The best time frame for candlesticks is daily bars and relatively short holding periods from 1 to ten days. Thus, candlesticks are most useful for short-term trading. We backtested different time frames from 15-minute bars to monthly bars.

Popular trading strategies include trend following, range trading, or breakout trading. Traders who choose this type of trading style need patience and discipline. It might take days for a quality opportunity to show up, or you might end up holding a trade open for a week or more while running an open loss.

The top and bottom of the body tell us the opening and closing prices during the given time period. The top and bottom of the shadows tell us the highest and lowest prices reached during the given time period. The top and bottom of the candlestick body reflect the opening and closing prices in the given time period.

After you choose your candle wax type, Armatage Candle Company recommends that beginners follow the 84-candle rule. In other words, make 84 candles to build your skill with the craft. Then give all of them away and take in feedback and any other valued learnings.

Do candlestick patterns work?

Yes, candlesticks can work as a predictive tool. The article mentions testing 23 different candlestick patterns quantitatively with strict buy and sell signals. Some patterns have shown effectiveness, and the article suggests that additional variables could further improve their performance.

The 8-10 Rule: Place one 8 ounce candle for every 10 feet radius of room. It's a good rule of thumb to follow the 8-10 rule to ensure your candle scent permeates the entire room equally.

In this case, it's best to use fewer candles, such as 10 or 20. For longer timeframes, such as daily or weekly charts, using more candles can provide a better overall view of the trend. In this case, using 50 or 100 candles may be appropriate.

Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. The pattern consists of three consecutive long-bodied candlesticks that open within the previous candle's real body and a close that exceeds the previous candle's high.

Triple candlestick patterns can be bullish or bearish. Triple candlestick patterns such as the morning star, morning star doji, bullish abandoned baby, three white soldiers, three inside up, and three outside up signal bullish trend reversals.

Christopher Duffy's Post. Candle Patterns Professional traders often utilize candlestick patterns as a part of their technical analysis toolkit. These patterns provide insights into market sentiment and potential price movements.

The rarest candlestick pattern is often considered the "Abandoned Baby." This pattern is a reversal indicator characterized by a gap followed by a Doji, which is a candle with a small body, and then another gap in the opposite direction.

A black or filled candlestick means the closing price for the period was less than the opening price; hence, it is bearish and indicates selling pressure. Meanwhile, a white or hollow candlestick means that the closing price was greater than the opening price. This is bullish and shows buying pressure.

If we talk about the best candlestick time frame for day trading, the most commonly used time frame charts for intraday trading time are the 5-minute candlestick chart and the 15-minute candlestick chart. The candlesticks have four points that are commonly called OHLC (open high low close).

For day trading, the most reliable candlestick pattern is the Doji pattern, as it indicates indecision in the market and could potentially signal a reversal or continuation of the existing trend.

How do you predict the next candle in 1 minute trade?

By analyzing the number and average size of green to red candlesticks, we have a simple way to define the trend with a glance at our charts (one big advantage with a candlestick chart compared to a line chart.) So if we have more green candles than red candles and the average size if larger for green candles.

The low of the candle is the lower shadow or tail, represented by a vertical line extending down from the body. If the close is higher than the open, then the body is colored green representing a net price gain. If the open is higher than the close, then the body is colored red as it represents a net price decline.

A candlestick chart is a graphical representation used in financial analysis to display the price movement of an asset. This may include a stock, currency, or commodity, over a specified period of time. It consists of individual "candlesticks," each representing a specific time frame (e.g., a day, hour, or minute).

Rule 1: Education Is Key

Before diving into the world of forex trading, invest time in education. Learn about the forex market, how it operates, the various trading strategies, and technical and fundamental analysis. Continuous learning will help you make informed decisions and develop effective trading strategies.

Traders use candlestick charts to see the open, high, low, and close of a stock over a time frame. The body of a candlestick chart further allows you to know how a stock closed relative to its open. It is typically colored red for down days and green for up days.

References

- https://www.forex.com/en/news-and-analysis/how-to-read-candlestick-charts/

- https://www.investopedia.com/articles/active-trading/092315/5-most-powerful-candlestick-patterns.asp

- https://blog.mexc.com/the-best-candlestick-patterns-for-crypto-trading-creator-wilbur/

- https://www.quantifiedstrategies.com/how-many-candlestick-patterns-are-there/

- https://www.linkedin.com/pulse/top-20-chart-candlestick-patterns-traders-union-olga-shendetskaya-jqbne

- https://www.ig.com/en/trading-strategies/the-best-beginners--guide-to-buying-and-selling-forex-201127

- https://tradingwalk.com/simple-candlestick-strategy

- https://www.gffbrokers.com/harnessing-the-5-8-13-exponential-moving-average-ema-trading-indicator/

- https://www.audacitycapital.co.uk/trading-guides/forex-for-beginners/how-much-to-start-forex-trading/

- https://www.t4trade.com/en/what-is-the-hardest-month-to-trade-forex/

- https://school.stockcharts.com/doku.php?id=chart_analysis:candlestick_bullish_reversal_patterns

- https://www.investopedia.com/terms/t/three-inside-updown.asp

- https://www.5paisa.com/stock-market-guide/online-trading/how-to-read-candlestick-charts-for-day-trading

- https://blog.whitebit.com/en/what-is-a-hammer-candlestick-pattern/

- https://www.linkedin.com/pulse/10-golden-rules-forex-trading-broker-forex-global-nxc5c

- https://www.linkedin.com/pulse/what-90-rule-forex-broker-forex-global-czp0c

- https://www.investopedia.com/terms/p/pip.asp

- https://www.thatsucks.com/four-candles-strategy-advanced-breakout-strategy-for-binary-options/

- https://www.shareindia.com/knowledge-center/intraday-trading/intraday-trading-indicators

- https://www.linkedin.com/pulse/how-long-should-i-hold-forex-trade-best-trader-2lv2c

- https://www.quantifiedstrategies.com/do-candlesticks-work-a-quantitative-test/

- https://www.babypips.com/learn/forex/triple-candlestick-patterns

- https://www.warriortrading.com/how-to-read-stock-charts-for-beginners/

- https://www.tradingsim.com/blog/5-minute-bar

- https://www.litefinance.org/blog/for-beginners/how-to-read-candlestick-chart/single-candlestick-patterns/

- https://www.companionlink.com/blog/2023/02/what-charts-do-professional-traders-use/

- https://www.quantifiedstrategies.com/what-is-the-best-time-frame-for-candlesticks/

- https://aliceblueonline.com/what-is-pullback-trading/

- https://www.axi.com/uk/blog/education/forex/forex-charts

- https://learn.bybit.com/candlestick/how-to-read-candlestick-charts/

- https://www.quora.com/Is-it-important-to-learn-candlesticks-chart-pattern-to-be-successful-in-stock-market

- https://www.indiainfoline.com/knowledge-center/online-share-trading/candlestick-wick-analysis

- https://realtrading.com/trading-blog/1-minute-scalping-simple-smart-profit-driven-strategies/

- https://squareup.com/us/en/the-bottom-line/series/quickstart-guide/how-to-start-a-candle-business

- https://www.asiaforexmentor.com/how-to-read-candlesticks/

- https://www.hgtv.com/design/decorating/design-101/19-feng-shui-secrets-to-attract-love-and-money-pictures

- https://www.investopedia.com/terms/s/shadow.asp

- https://www.dailyfx.com/education/candlestick-patterns/top-10.html

- https://en.wikipedia.org/wiki/Candlestick_chart

- https://www.jaspersoft.com/articles/what-is-a-candlestick-chart

- https://www.dailyfx.com/education/candlestick-patterns/forex-candlesticks.html

- https://www.investopedia.com/terms/d/downside-tasuki-gap.asp

- https://www.investorsunderground.com/stock-charts/candlestick-charts/

- https://www.investopedia.com/articles/active-trading/062315/using-bullish-candlestick-patterns-buy-stocks.asp

- https://www.whselfinvest.com/en-be/trading-platform/free-trading-strategies/tradingsystem/55-1-minute-breaks-daytrading-scalping-free

- https://nononsensetrader.com/1-candle-rule/

- https://en.wikipedia.org/wiki/Temple_menorah

- https://www.strike.money/technical-analysis/triple-candlestick-patterns

- https://www.ig.com/us/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615

- https://www.indmoney.com/articles/stocks/best-candlestick-patterns-for-trading-what-are-the-key-components-to-analyze

- https://fxopen.com/blog/en/three-working-5-minute-trading-strategies/

- https://www.forextime.com/education/candlestick-trading-charts

- https://zebpay.com/in/blog/how-to-read-candlestick-patterns

- https://www.kotaksecurities.com/intraday-trading/which-time-frame-is-best-for-intraday-trading/

- https://ux.stackexchange.com/questions/103089/why-most-of-online-trading-platforms-use-red-and-green-for-buy-and-sell-buttons

- https://realtrading.com/trading-blog/candlestick-patterns-day-trading/

- https://www.investopedia.com/trading/candlestick-charting-what-is-it/

- https://www.ig.com/uk/forex/fx-need-to-knows/forex-indicators

- https://www.scribd.com/document/635378618/Two-Candle-Theory-High-Probability-Trades

- https://altfins.com/knowledge-base/ema-12-50-crossovers/

- https://health.mil/Military-Health-Topics/MHS-Toolkits/Brand-Resources-for-Communicators/Color-Psychology-Guide

- https://www.linkedin.com/pulse/1-minute-time-frame-good-trading-forex-guru-eoapc

- https://www.autonomous.ai/ourblog/what-are-the-colors-that-attract-money

- https://www.litefinance.org/blog/for-beginners/trading-strategies/three-profitable-forex-trading-strategies/

- https://www.vellabox.com/five-secrets-for-the-best-candle-experience/

- https://investfox.com/education/indicators/best-one-minute-moving-average/

- https://blog.hubspot.com/the-hustle/psychology-of-color

- https://www.marklittler.com/sell-your-antique-silver-candlesticks/

- https://www.dummies.com/article/business-careers-money/personal-finance/investing/investment-vehicles/stocks/candlestick-charting-for-dummies-cheat-sheet-209309/

- https://school.stockcharts.com/doku.php?id=chart_analysis:candlestick_bearish_reversal_patterns

- https://centerpointsecurities.com/bullish-candlestick-patterns/

- https://www.axiory.com/trading-resources/basics/how-to-read-candlesticks-charts

- https://www.nirmalbang.com/knowledge-center/intraday-trading-charts.html

- https://bitcointalk.org/index.php?topic=3209219.0

- https://www.investopedia.com/articles/trading/10/high-performance-charts.asp

- https://fastercapital.com/content/Candlestick-vs--Renko-Charts--Which-is-the-Best-for-Technical-Analysis.html

- https://renner.org/article/golden-candlesticks/

- https://www.forex.com/ie/news-and-analysis/how-to-use-the-5-3-1-trading-strategy-in-forex/

- https://www.quora.com/How-do-I-use-a-big-bar-strategy-in-scalping

- https://groww.in/blog/how-to-read-candlestick-charts

- https://kriptomat.io/finance-investing/candlestick-chart/

- https://www.xtb.com/en/education/what-are-the-best-trading-days-for-forex

- https://www.quora.com/How-many-candles-can-you-use-on-a-chart-before-the-accuracy-starts-to-decrease

- https://www.quora.com/What-is-a-one-hour-candle-in-Forex-trading-and-what-advantages-does-it-have-over-other-expiry-times-such-as-five-minutes-or-ten-minutes

- https://www.linkedin.com/posts/christopher-duffy-bdpim_candle-patterns-professional-traders-often-activity-7096048888326807552-bij5

- https://fxopen.com/blog/en/how-to-trade-with-three-inside-up-down-candlestick-patterns/

- https://www.fmz.com/strategy/435828

- https://www.mathworks.com/matlabcentral/fileexchange/40614-three-red-candles-trading-strategy

- https://tradeciety.com/how-to-trade-candlestick-patterns-like-a-pro

- https://www.axi.com/int/blog/education/forex/forex-trading-strategies

- https://blueberrymarkets.com/market-analysis/news/what-is-5-3-1-trading-strategy/

- https://wealthyeducation.com/win-90-percent-of-the-time/

- https://www.forbes.com/advisor/investing/what-is-day-trading/

- https://www.quora.com/What-is-the-5-candle-rule

- https://www.babypips.com/trading/top-7-candlestick-patterns-to-use-in-trading-forex-and-crypto

- https://www.investopedia.com/terms/t/three_white_soldiers.asp

- https://www.ig.com/en/trading-strategies/16-candlestick-patterns-every-trader-should-know-180615

- https://www.quora.com/How-do-I-predict-the-next-candle-in-binary-trading-with-pressure-and-shock

- https://www.investopedia.com/articles/active-trading/040914/understanding-hanging-man-optimistic-candlestick-pattern.asp

- https://www.bitpanda.com/academy/en/lessons/bullish-candlestick-patterns-in-crypto-trading-you-should-know

- https://www.investopedia.com/articles/active-trading/011815/top-technical-indicators-rookie-traders.asp

- https://www.prosperitycoaching.biz/a-psycology-of-color-and-your-brand/

- https://choiceindia.com/blog/best-time-frame-for-intraday-trading/

- https://www.mystockodds.com/blog/is-candlestick-trading-accurate

- https://www.fpmarkets.com/blog/predict-and-calculate-candlestick/

- https://zerodha.com/varsity/chapter/single-candlestick-patterns-part-2/